Help bk dated June 23 460. A sample design of a draft decree of the President of the Russian

at least 9 cm

PRESIDENT OF THE RUSSIAN FEDERATION

On approval of the Regulations on the Office of the President Russian Federation on

state awards

18 pt

1. To approve the attached Regulations on the Administration of the President of the Russian Federation for state awards.

2. This Decree shall enter into force on the day of its signing.

President of Russian Federation

Moscow Kremlin

Sample design of the draft decree of the President of the Russian

Federations

APPROVED

Decree of the President of the Russian Federation No.

REGULATIONS

on the Office of the President of the Russian Federation for state awards

1. The Directorate of the President of the Russian Federation for State Awards (hereinafter referred to as the Directorate) is an independent subdivision of the Administration of the President of the Russian Federation.

2. The Department in its activities is guided by the Constitution of the Russian Federation, federal laws, decrees and orders of the President of the Russian Federation, regulations on the Administration of the President of the Russian Federation, orders of the Administration of the President of the Russian Federation, as well as this regulation.

at least 9 cm

ORDER

PRESIDENT OF THE RUSSIAN FEDERATION

1. Allocate in 2009 from the Reserve Fund of the President of the Russian Federation:

4 million rubles to the government of the Vologda Oblast for the Vologda State Historical, Architectural and Art Museum-Reserve (Vologda, S. Orlova St., 15) for the repair and restoration of a monument of history and culture - Samarin's House, located at the address. Vologda, Sovetsky prospect, 16b;

President of Russian Federation

Sample design of the draft order of the President of the Russian Federation

Annex No. 14 to clause 3.3.3.

Preparation and execution of draft acts (decrees, orders) of the Government of the Russian Federation

Preparation and execution of draft acts (decrees and orders) of the Government of the Russian Federation is carried out by federal bodies executive power in accordance with the procedure established by the Government of the Russian Federation.

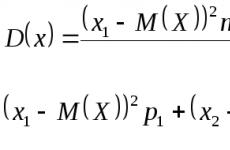

The draft resolution or order of the Government of the Russian Federation is printed on standard sheet A4 paper in font size No. 14. The draft act has the following details:

Name of the type of act- Decree of the Government of the Russian Federation or an order of the Government of the Russian Federation.

The date of the act is separated from the name of the type of act, as a rule, with a line spacing of 24 pt, it is drawn up in a word-digital way, it is printed in a centered way, it is affixed when the act is signed.

The number is printed immediately after the date in Arabic numerals and consists of the sign No. and a serial number assigned to the document after it is signed, for example, No. 143.

The letter “r” is added to the ordinal number of the order through a hyphen, for example, No. 153-r.

Place of publication - separated from the details "Date" and "Number" with a line spacing of 24 pt and is drawn up in a centered way.

The heading is printed at least 10 cm from the top edge of the page with capital letter, one line spacing and in bold. The title, as a rule, answers the question: what (about whom) the document is published. There is no dot at the end of the heading.

The text is separated from the headline by a line spacing of 24-36 pt and is printed with a spacing of 18 pt.

The text is printed from the left border of the text field and aligned to the left and right borders of the text field. The first line of a paragraph starts 1.25 cm from the left margin.

The text can be divided into a stating part (preamble) and an operative part (orders - administrative).

The preamble in the draft resolutions of the Government of the Russian Federation ends with the words “The Government of the Russian Federation p o - s t a n o v l i e t”, the last word is printed in bold in spacing.

The preamble may be omitted if the prescribed action does not need clarification.

The operative (administrative) part of draft resolutions (orders) of the Government of the Russian Federation, as a rule, is divided into paragraphs.

Items are numbered in Arabic numerals with a dot and do not have headings.

If there are annexes to the decree (order) of the Government of the Russian Federation, a reference to them must be made in the text.

The signature is separated from the text by a line spacing of 36 pt and consists of the words "Chairman of the Government of the Russian Federation", the initial of the name and surname of the Chairman of the Government of the Russian Federation. The words "Chairman of the Government" and "Russian Federation" are printed in two lines with 1 line spacing. The words "Chairman of the Government" are printed from the left border of the text field, and the words "Russian Federation" are centered relative to the first line of the attribute. The initial name and surname of the Chairman of the Government of the Russian Federation are printed at the right border of the text field.

Annexes to draft acts (decrees and orders) of the Government of the Russian Federation are printed on separate sheets of paper and endorsed.

Field sizes, fonts and line spacing when printing text are identical to the sizes used in the design of texts of resolutions (orders).

The procedure for drawing up annexes to a draft resolution (order) of the Government of the Russian Federation is similar to drawing up annexes to draft decrees (orders) of the President of the Russian Federation.

Visas are issued on reverse side the last page of the first copy (original) of the draft resolution (order) in its lower part.

If the text of a draft act of the Government of the Russian Federation mentions previously adopted acts of the President of the Russian Federation or the Government of the Russian Federation, then a reference is made to the appropriate official source for their publication, for example: (Sobraniye zakonodatelstva Rossiyskoy Federatsii, 2005, No. 3, Article 6).

If the prepared act of the Government of the Russian Federation entails the introduction of amendments or additions to other acts of the Government of the Russian Federation, these amendments or additions are included in the draft act being prepared or submitted as an independent act simultaneously with it.

A draft act of the Government of the Russian Federation on organizing the execution of a federal law or an act of the President of the Russian Federation must contain a reference to the relevant federal law or act of the President of the Russian Federation.

In draft resolutions of the Government of the Russian Federation, the full official names of bodies and organizations are used; in draft resolutions, their abbreviated official names are used.

Documents (programs, regulations, regulations, plans, norms, etc.) that are proposed to be approved by the prepared draft act of the Government of the Russian Federation, in without fail attached to this draft document.

Draft acts of the Government of the Russian Federation are submitted to the Government of the Russian Federation with a cover letter, which indicates the reason for submitting the draft act, and also contains information about the content and approval of the draft act or lack of approval (with reasons). The cover letter is signed by the head of the federal executive body or a person acting in his capacity. The draft act is endorsed by the person submitting the draft and agreed in the manner prescribed by the Regulations of the Government of the Russian Federation.

Samples are attached.

Filling in by citizens of a certificate in the form of form No. 460 implies the provision of information on income received by them, expenses incurred, as well as real estate owned and current property obligations. In this material, we will consider who fills out the income statement 460, what is the procedure for entering data into it and whether there are any features of its implementation.

Consider a list of persons who are obligated to provide information about funds and property in the form of a certificate under discussion. These include persons from the category of those who fill the positions corresponding in importance.

Table 1. Who must provide information in the 460 certificate

| Representatives | |

|---|---|

| Category 1 | People in the public service of the Russian Federation, its separate subject, municipal units that are permanently occupied. |

| Category 2 | Representatives working in: state nature of corporate associations; PF RF; FSS RF; FMS; other structures organized by the authorities, with positions appointed and removed from them by the guarantor of the Constitution, as well as positions determined by the legal regulatory acts of organizations of this kind. |

| Category 3 | Employees of organizations that were created in order to implement procedures for the implementation of various tasks facing state bodies at the federal level, holding positions in accordance with a signed labor contract, included in the lists previously issued by federal state bodies. |

Is the provision of data mandatory?

According to the letter of the law of our country, the release of a person falling into the above list of categories of employees from the fulfillment of this obligation is impossible. He is forced to perform it even while on vacation:

- paid;

- unpaid;

- forced due to illness;

- child care, etc.

If the employee is unable to provide information on his own due to partial disability, then he is charged with sending it to the organization through:

- mail of standard type;

- electronic communications network.

When is the information required to be submitted?

This information is provided at the time of submission of documents for obtaining official authority by occupying a specific position. Simply put, the certificate must be filled out and returned before you officially take a specific position. When preparing the main papers, at the same time you will have to bring form No. 460.

- the President of the Russian Federation;

- representatives who are members of the Government of the Russian Federation;

- the secretary who is in this position in the Security Council of the Russian Federation;

- members serving in the Administration of the President at the federal level.

- TSB RF;

- PF RF;

- FSS RF;

- FMS RF;

- corporations and other companies of a public nature, created for the implementation of different kind tasks presented to them by government agencies at the federal level.

The person has the right to provide data, starting from the first day of the subsequent one-year period, which began after the one for which the reporting will be provided. It is strictly not recommended to delay the provision of information, it is especially necessary to remain attentive when an employee plans to soon be sent to another city, country, or go on vacation.

Who is the information being collected from?

A citizen filling out a certificate is obliged to provide information not only for himself, but also for some persons related to him, that is, for:

- wife or husband, depending on the gender of the person providing the data;

- for minor children (for each of them separately).

Entering data is done for each person in a separate paper.

Let's take an example. You hold one of the previously listed positions, while you have a spouse, daughter and son, 16 and 17 years old respectively. It turns out that, when handing over the paper filled out for yourself, you must submit three more for relatives. It makes only four.

Reporting periods and the timing of data transfer for processing differ between civil and government employees. The first provide:

- information on the funds received by them, for 12 calendar months, as well as on the income of the wife, husband, minor offspring, for the same time period, submitted for the next year;

- data on objects of a property nature owned by the person submitting information, the wife / husband of this citizen and minor children, and on obligations of a property nature.

Employees provide certificate No. 460 every twelve months:

- entering information about the received and spent financial resources of their own, husband, wife, offspring who have not grown to adulthood, which were received or made in the calendar 12 months that have passed before the current one-year period when information is provided;

- indicating data on the immovable property owned by him, as well as the property of his spouse or spouse, children who have not reached the age of majority, according to the state of the last day of December of the previous year in which the certificate was issued for a twelve-month period.

The provision of data to employees is mandatory if at the end of December of the reporting year one of the following circumstances occurred:

- the position that was replaced by him is among the items in the list of relevant areas of activity;

- the position is occupied temporarily, and it is in the list of relevant activities.

The employee who has taken up the relevant post is not required to provide information on the form if he is on it temporarily and the appointment to him did not enter into force on January 1 or during the entire next year following the reporting twelve-month period.

How to identify family members who also need to provide information

As we have already mentioned, an employee who is obliged to provide up-to-date data on himself on a specific date, consisting in the expenses and income he receives, is also obliged to declare the property of his family, that is, his wife or husband, as well as children under eighteen years of age.

When an organization decides on the importance of declaring information about the husband or wife of an employee, it is necessary to take into account the paragraphs of Article No. 25 of the RF IC. It says that a spouse is only a citizen whose marriage is officially sealed through the registration procedure, and the presence of an act of the corresponding state of citizens. The marriage also ends by obtaining a similar act of dissolution and making a note in the registration book.

If, as of December 31 of the reporting year, the employee was no longer the spouse of anyone, then information about his former second half is not provided. At the same time, it does not matter how many times during the year you got married or divorced, only the status of an official on the reporting date of providing information matters.

With regard to children who have not reached the age of majority, it must be taken into account that, according to the Constitution, the day of majority for a child becomes the day following the birthday.

Let's take an example. You provide data on finances that have become your income, money spent, property and liabilities of a financial and property nature in 2017, for the past year. Your daughter came of age last May. Since the reporting period is December 31, 2016, the form for it does not need to be filled out and submitted to the organization.

The same situation will be for a child who reached the age of 18 on December 30, since on the next day, reporting for the provision of documentation, he is already considered an adult. If the birthday passed on December 31, and the daughter's majority came into force only on January 1, 2017, a certificate on it will need to be filled out and submitted for consideration.

If it is not possible to provide data on family members, and this state of affairs arose objectively, the employee is obliged to write and submit a corresponding application to a number of state bodies.

Instructions for filling out certificate No. 460

Consider how to fill out the discussed certificate. In the form in which we know it now, it was approved in 2014 by issuing a presidential decree.

If a citizen independently fills out the form, he has the right to enter data:

- using a computer;

- on other printing devices.

In addition, each sheet to be filled out must be signed by the employee or citizen filling out the paper.

Step number 1 - fill out the title page

The title page is filled out first.

- At the beginning, indicate the name of the employee who provides the organization with information. Abbreviations are not allowed. Filling in is done exactly as these data are indicated in the main document of the citizen.

- If the certificate is filled out for a family member, his full name is also indicated, while one of the options for the column where family ties between the employee and the specified person.

- Next, the real date of the birth of the person is indicated, the day, month, year is fully prescribed, similarly to the information indicated in the citizen's passport.

- From the order in hand on the appointment of this employee to a specific position, the organization is rewritten in full name - the place of work, as well as the position in which the employee entered.

- Next, the place of residence of the person is entered, according to his registration, current on the day on which the certificate is provided. It is necessary to rewrite the data from the passport without making mistakes. Enter:

- region;

- city or other locality;

- the outside;

- flat;

- the postal code of the post office corresponding to the place of residence.

If a citizen's residence permit is temporary, it must be indicated in brackets after the main one. If there is no main one, a temporary one is entered instead.

If the person filling out the form or his relatives do not live at the place of registration, then after the official address in brackets indicate the actual one.

Step number 2 - fill out the first section with information about income received

The income of an employee or members of his family refers to cash receipts in any form that took place in the period for which reporting is provided.

Paragraph 1. Funds received as wages at the place of employment.

This column contains the income that the employee received in state organization where he holds any of the above positions for the time period for providing up-to-date information. Vessels enter the full amount of funds received. You can find it in the 2-NDFL form issued by the accounting department.

Don't know how to fill out the 2-personal income tax form? You can familiarize yourself with this topic on our portal. Step-by-step instructions, a sample form, as well as how to avoid basic mistakes when filling out a declaration.

If the transition to a position occurred during the reporting period, it is necessary to enter the funds received in the previous position or place of work in the column for income of a different nature.

Point 2. Funds received in the form of income from activities of the nature of:

- pedagogical;

- and/or scientific.

In this period, the amount of income received is entered if the employee carried out activities of a pedagogical nature, as well as scientific. with its value can be obtained at the place of conclusion of the contract on teaching and conducting scientific works on a reimbursable basis. This column also includes the writing of teaching aids, and other works that are intellectual property submitting form No. 460 of the person.

If this activity was carried out at the main place of employment, then this column is not filled in, and the income is paid in the first paragraph of the section under consideration.

Point 3. Income received from activities of a creative nature.

Inside this column, the amount of funds received that were paid to a citizen for conducting creative activities is entered, for example:

- writing literary works;

- painting pictures;

- creation of sculptures;

- production of photographs for further embodiment in print;

- writing musical works;

- video filming, etc.

Item 4. In lines numbered two and three, enter the amounts received in the form of grants from the state or organizations of an international and other nature, which will go as support for culture, art, scientific and educational activities.

Item 5. The money received for deposits made in credit institutions fit into the column with the appropriate name. It will contain data on interest received for the reporting period from bank deposits or deposits from other types of credit organizations. It doesn't matter what currency the deposit is made in.

Note! Funds received on a deposit that was closed during the reporting period must also be indicated.

Item 6. Funds received from securities and for share in commercial organizations. In this column, enter the amount of funds received, which may be:

- money issued as a result of the division of profits received by the organization, less tax collection, according to the size of the shares of each shareholder, in other words - dividends;

- interest on deposits or debt obligations from domestic sole proprietors or Russian representative offices of foreign companies;

- money that came from transactions carried out with papers of value, while the papers themselves are entered in the section of the form under discussion at number 5.

Item 7. Other income is indicated in the corresponding line. These include:

- pension accruals;

- sums of money due for pensions, which play the role of an additional payment assigned by the state to certain categories of citizens;

- various benefits issued on a permanent or temporary basis, for example, benefits for pregnant women or those who gave birth, benefits of a social nature, etc.;

- funds for maternity capital if they were used in full and in part during the reporting period;

- alimony received for a child or yourself;

- scholarship payments;

- any subsidies associated with the decision housing problems received during the reporting period;

- rent for the removal of property of the employee filling out the form;

- funds received as a result of the sale of real estate and property of a different type, for example, a car;

- money resulting from the sale of valuable securities or parts of commercial companies;

- money earned as a result of labor carried out in combination with the main place of work;

- remuneration paid to an employee as a result of the conclusion of civil law contracts;

- operating income engineering networks and communication of various types;

- donated money;

- compensation for harm caused to the health of an employee;

- payments that reimburse the costs of obtaining additional qualifications;

- inheritance;

- insurance payments;

- funds due to the employee upon dismissal from the 2-NDFL form from the previous place of employment;

- financial rewards for donating blood, plasma and other components to people;

- financial assistance of a charitable nature provided to an employee or his relatives;

- all payments to disabled people or pensioners, as well as to minor children, which are compensatory in nature, for example, reimbursement of funds spent on paying for vouchers to a sanatorium, etc.

- prizes for participation in events such as lotteries and other kinds;

- travel allowances;

- reimbursement of travel expenses to the place of rest during the holiday.

Step number 3 - fill out the second section

This section is to be completed only if the reporting period included cash receipts from purchase transactions:

- cars;

- cottages and other residential real estate;

- shares;

- papers of value.

As a result of completed transactions, the expenses incurred must exceed the total receipt of funds for the past 36 months.

Let's take an example. You submit certificate No. 460 at the place of work, while in 2017 you bought Vacation home. Summing up the income received from 2014 to 2016, you get an amount less than the cost of the purchased property, therefore, indicate the transaction in the second section of the form.

If at the time of the purchase of the property, funds provided by government agencies were involved, you are in any case obliged to provide this information.

In the corresponding column for real estate owned by the employee's family, indicate:

- location as a full address;

- the amount of its footage.

For motor vehicle movements include:

- model;

- variety;

- belonging to a certain brand;

- when the car was released.

For papers of value:

- variety;

- issued by YL.

Since the property was worth more than the income received over the past 36 months, the column must be filled in, inside which the source of the incoming funds is shown. His role may be:

- funds obtained through the labor of the wife/husband;

- other legal income of the employee;

- interest on family deposits;

- funds accumulated over the past year;

- money received by the heirs of a deceased relative;

- donated money;

- taken a loan of a targeted or non-targeted nature;

- funds received as a result of the sale of other property;

- rent;

- a subsidy from the state;

- maternal capital.

The form of entering this source and indicating the circumstances in which the funds were acquired is free.

Step number 4 - fill out section three

Paragraph 1. In this part of the form, information is entered on the immovable property that is owned by the employee or one of the representatives of his family. It includes:

- plots of land;

- bowels;

- houses and other buildings that cannot be separated from the ground without irreparable damage.

In addition, ships are considered real estate:

- marine;

- space;

- air;

- inland navigation.

Point 2. According to the list, the third section includes all real estate that belongs to the employee of the organization or his spouse and children, while the date of its acquisition does not matter.

In the form and name of property objects, you can specify land plots of the following type:

- garden - for growing berries, fruits, vegetables and other crops and recreation;

- garden - for growing vegetables, fruits, berries, other crops on which various structures can be erected;

- garden land - for growing any crops and farming, as well as the construction of buildings;

- suburban land - for recreation, they can build the necessary buildings in which you can not register, but you can live, and the land is provided for growing crops.

Point 3. Under personal farming, which has the character of subsidiary, the law implies the cultivation and processing of products represented by agricultural names. Land is suitable for its implementation, both within the city and outside it.

Item 4. For the production of products Agriculture use the so-called personal plots, in addition, residential buildings are erected on them, and outbuildings corresponding to established state regulations in the field of urban planning, concerning aspects:

- sanitary and hygienic;

- construction;

- environmental;

- preventing fires, etc.

As for the land for the construction of an individual building, it should be noted that the role of such a building is assigned to a residential house, standing separately from the rest, while the maximum number of storeys for it is three units. One family should live inside such a house.

If an employee enters for himself or his spouse, or children in the third section property in the form of a house suitable for habitation, country or garden, he must also provide information on the plot of land on which the building is located.

Item 5. When it is implied that a dwelling is entered in the form of an apartment, the following information about it is indicated:

- square;

- number of rooms;

- type, etc.

For a garage or a place where a vehicle is stored, data is provided in the form of paper, indicating that it is owned.

Item 6. The line in which you need to enter the type of property implies one of following options response:

- share;

- joint;

- individual.

According to the Civil Code of the Russian Federation, property is jointly owned if it belongs to several persons without determining the size of the shares of each. In fractional ownership, if the size of the shares is known. And individual, if he has one owner.

For general property, all owners are listed, regardless of whether their ownership shares are defined.

Item 7. For real estate in Russia, enter:

- postcode;

- region;

- area;

- locality;

- street;

- building number;

- apartment number.

For real estate located in another country they write:

- country of location;

- locality;

- address.

The area of the name is entered according to the documents confirming the ownership of the employee or his relatives. In addition, for each object in possession, it is indicated on what basis it was acquired, and from what source the funds for the acquisition were received.

Item 8. The subsection on vehicles contains data on those cars, motorcycles and other vehicles that are in the possession of an employee, no matter how long ago they were purchased and where they were registered.

Means that are also subject to indication inside the certificate are:

- stolen;

- used by third parties on the basis of a power of attorney;

- who are under bail credit institution;

- not on the move;

- which have been discontinued.

If the car was sold before the reporting date, then it can be omitted from the certificate.

Step number 5 - fill out the fourth section

This section involves entering information on bank accounts. These include accounts not only of the employee himself, but also of representatives of his family, even if the reporting employee himself is not a client of this credit institution.

Paragraph 1. Inside it, information is also provided on metal accounts of an impersonal nature, that is, accounts actually in precious metals. In the appropriate columns, it is necessary to reflect the number of grams of precious metals that the reporting person has, as well as what their conversion into rubles will be.

In addition, they indicate accounts on salary bank cards issued at the place of work, while entering:

- Name of the bank;

- in what form does the account exist;

- in what currency it is conducted;

- when it was discovered;

- how much money remained on the plastic card for the reporting period.

Point 2. Availability of credit or overdraft bank cards also entered in this part of the form. If there is a debt of more than half a million rubles on them, it must be recorded in a specially designed column of the section.

Point 3. In addition, existing accounts are reflected:

- settlement nature - for conducting financial transactions presented in the conduct of entrepreneurial activities, and in addition to achieving the goals of non-commercial companies;

- current nature - to perform actions that are in no way related to doing business;

- trust management - for the purpose of conducting activities in the relevant direction;

- on deposits - made cash deposits;

- specialized — for paying agents, subagents, clearing, nominee, escrow, etc.;

- deposit - for courts and other objects of the legal sphere.

The information indicated in the certificate form must be 100% consistent with the data entered in the bank statements.

Filling in the line containing information on the money credited to the desired account is carried out only in a situation where the total amount of financial injections for him is greater than the income of the employee and his spouse for the established reporting period plus the 24 months that have passed before him. For currency accounts, the values are indicated in rubles.

Item 4. If the person's account was closed before the reporting date or the banking organization through which it was created was liquidated before the specified deadline, it is not necessary to indicate it inside the form in question.

Step number 6 - fill out section number five

This section of the form receives information regarding the securities of a valuable nature that the employee has. The cash income coming from them is also included, but its size is included in the first section.

Paragraph 1. In the appropriate columns, information is entered about the stock securities that are of value to the citizen, employee of the desired structure, while indicating:

- the organization that provides these papers;

- the format of the organizational and legal structure of the given society.

Point 2. Then they contribute the amount of capital in accordance with the charter available in the organization, recorded by means of the presented indicators of the constituent documentation, corresponding to the date of reporting. If the capital is presented in foreign currency, then the entry is still made in rubles, according to the exchange rate provided by the Central Bank of the Russian Federation.

Point 3. In addition to information on shares, it is necessary to enter information about other securities, which may include:

- mortgages;

- bills of lading;

- checks;

- investment shares;

- certificates

- bills;

- bonds, etc.

Item 4. Having calculated the total value of all valuable papers in your hands, you must indicate its value in the advising column.

Step number 7 - fill out the sixth section

This part of the certificate contains information about the obligations of the employee and members of his family, which are of a property nature.

Paragraph 1. It includes information on property represented by immovable objects that are used by the employee providing the certificate or his relatives, only temporarily, in addition, for this use it is necessary to have a basis in the form of an agreement.

These are things that are not owned by the employee:

- residential premises, inside which an employee of any state structure or members of his family live, while not concluding a lease agreement or drawing up other documents of this kind;

- apartments or other objects rented in accordance with a signed lease agreement, use on a gratuitous basis or hiring of a social nature.

In this case, it is necessary to enter data on the total size of the area of the name under discussion.

This part of the section is filled in by those citizens who do not live in the locality where they work or serve, but are there temporarily, on the rights of registration, which are also of a temporary nature.

Point 2. It is mandatory to enter:

- type of object;

- it is rented or used free of charge;

- for how long the dwelling is occupied;

- on what basis the employee and his family received the right to live in it (contract, etc.).

Point 3. In the part concerning monetary obligations, having an urgent nature, contribute family debts of more than half a million rubles. It is described in the corresponding line that it is:

- credit;

- loan, etc.

Note! An employee can be both a debtor and a provider of funds, so the correct person must be indicated on the line containing information about the creditor or debtor.

Item 4. On the basis of the occurrence of financial obligations, an agreement or other regulatory act is prescribed confirming the existence of a debt.

Item 5. The amount of the obligation is entered in the column with the same name, the amount of the obligation, that is, the unpaid balance, is indicated next. It does not matter whether the money is taken in foreign currency, the description in any case is made in rubles, according to the exchange rate presented by the Central Bank of the Russian Federation.

The terms of an existing obligation contain information on:

- interest rate;

- whether any property is pledged under it;

- what guarantees were provided;

- whether there was a guarantee.

In addition, enter all the documents accompanying the loan. This also includes official agreements regarding participation in the construction of a shared character, at the same time, data on the state registration procedure that the facility under construction has passed must be entered.

SPO "Spravka BK" is aimed at automating the workflow and greatly simplifies the labor process for both taxpayers and inspection authorities. More detailed description and step by step instructions for filling you will find in our special article.

Video - Educational film "Filling out income statements"

Summing up

As you can see, certificate form No. 460 is a rather voluminous paper form, inside which you need to enter a large number of varied information. In order not to be mistaken, it is advisable to consult with the specialists of the accounting department at the place of employment, otherwise you will have to reissue the paper several times. Do not be afraid, in fact, not everything is so scary, most employees filling out the form skip a lot of sections, since only very wealthy people need to enter data on all of them. In practice, their combination is quite rare.

We wish you good luck filling it out!

Size: px

Start impression from page:

transcript

1 EXAMPLE OF COMPLETION Approved by Decree of the President of the Russian Federation dated June 23, 2014 460 To the Department of Personnel Policy and Work with Personnel of the Bank of Russia (the name of the personnel department of the federal state body, other body or organization is indicated) REFERENCE<1>on income, expenses, property and liabilities of a property nature<2>I, Ivanov Ivan Ivanovich, born, passport of the series, issued by the city of Moscow, Department of Internal Affairs for the Levoberezhny district, (last name, first name, patronymic, Date of Birth, series and number of the passport, date of issue and the authority that issued the passport) Department of Cash Circulation, Deputy Director of the Department, (place of work (service), occupied (replaced) position; in the absence of the main place of work (service) - occupation; position , for the replacement of which the citizen (if applicable)) is applying, registered at the address: , Moscow, st. Lavochkina, d. 6, kv.105, actually live at the address: Moscow region, Khimki, st. Lenina, d. 13, apt. Moscow, OVD "Yaroslavsky" (last name, first name, patronymic, year of birth, series and number of the passport, date of issue and authority that issued the passport), Moscow, Lavochkina str., 6, apt. 105, actually living in address: Moscow region, Lenina st., 13, apt. services) - occupation) from February - housewife for the reporting period from January 1, 2014 to December 31, 2014 on property owned by Ivanova Margarita Yurievna (surname, name, patronymic) on the right of ownership, on deposits in banks, securities , on obligations of a property nature as of December 31, 2014 1 _Filled out personally or using the use of specialized software in the manner prescribed by the regulatory legal acts of the Russian Federation. 2 _Information is submitted by a person filling a position, the exercise of powers for which entails the obligation to provide such information (by a citizen applying for filling such a position), separately for himself, for his spouse (spouse) and for each minor child.

2 Section 1. Information about income<3>Type of income Amount of income<4>Income from the main place of work, 00 2 Income from teaching and scientific activity 0 3 Income from other creative activities 0 4 Income from deposits in banks and other credit organizations 12870.00 5 Income from securities and shares in commercial organizations 0 6 Other income (specify the type of income): 0 7 Total income for the reporting period 93457 .00 3 _Income (including pensions, allowances, other payments) for the reporting period is indicated. _ 4 _Income received in foreign currency is indicated in rubles at the exchange rate of the Bank of Russia on the date of receipt of income.

3 Section 2. Details of expenses<5>Type of acquired property Transaction amount Source of funds from which the property was acquired Basis for acquisition<6>Land plots: 3) 2 Other real estate: 3 Vehicles: 4 Securities: 5 federal law dated December 3, 2012 230-FZ "On control over the compliance of expenses of persons holding public office and other persons with their income." If there are no legal grounds for providing the specified information, this section is not completed. 6 _The name and details of the document that is the legal basis for the emergence of ownership rights are indicated. A copy of the document is attached to this certificate.

4 Section 3. Information about property 3.1. Real estate Type and name of property Type of property<7>Location (address) Area (sq. m.) Reason for purchase and source of funds<8>1 Land plots<9>: being part of summer, horticultural and horticultural associations Shared (1 / Moscow region, Istra district, Petrovo village, DNT "Stroitel", account, 00 Certificate of ownership AA from, contract of sale from Residential houses, dachas: The dacha is under construction Joint (husband Ivanov Ivan Ivanovich, city) Moscow region, Istra district, Petrovo village, DNT "Stroitel", account, 0 Certificate of ownership VV from Apartments: do not have 4 Garages: do not have 5 Other real estate: do not have 7 _The type of ownership is indicated (individual, shared, common); for joint ownership, other persons (full name or name) who own the property are indicated; for shared ownership, the share of the person whose property information is provided. the name and details of the document that is the legal basis for the emergence of ownership rights, as well as in cases provided for by part 1 of article 4 of the Federal Law Law No. 79-FZ of May 7, 2013 "On the prohibition of certain categories of persons from opening and having accounts (deposits), keeping cash and valuables in foreign banks located outside the territory of the Russian Federation, owning and (or) using foreign financial instruments ", the source of funds at the expense of which the property was acquired. 9 _The type of land plot (share, share) is indicated: for individual housing construction, country, garden, personal, garden and others.

5 3.2. Vehicles Type, brand, model of vehicle, year of manufacture Type of ownership<10>Place of registration Passenger cars: DEU Matiz, 2009 individual 3rd division. MOTOTRER GIBDD ATC for the Central Administrative District of Moscow 2 Trucks: 3 Moto vehicles: 4 Agricultural machinery: 5 Water transport: 6 Air Transport: 7 Other vehicles: 10 Specify the type of ownership (individual, common); for joint ownership, other persons (full name or name) who own the property are indicated; for shared ownership, the share of the person whose property information is being submitted is indicated.

6 Section 4. Information on accounts with banks and other credit organizations Name and address of the bank or other credit organization Type and currency of the account<11>Account opening date Account balance<12>The amount received on the account Money <13>1 OJSC Sberbank of Russia, Moscow, Vavilova st., 19 2 OJSC Sberbank of Russia, Moscow, Vavilova st., 19 Depositary, ruble Current, ruble g, g,12 11 accounts (deposit, current, settlement, loan and others) and account currency. 12 _The account balance is indicated as of the reporting date. For foreign currency accounts, the balance is indicated in rubles at the exchange rate of the Bank of Russia as of the reporting date. 13 _The total amount of cash receipts to the account for the reporting period is indicated in cases where the indicated amount exceeds the total income of the person and his spouse (wife) for the reporting period and the two previous years. In this case, the statement of cash flow on this account for the reporting period is attached to the certificate. For foreign currency accounts, the amount is indicated in rubles at the exchange rate of the Bank of Russia as of the reporting date.

7 Section 5. Information about securities 5.1. Shares and other participation in commercial organizations and funds Name and legal form of the organization<14>Location of the organization (address) Authorized capital<15>Participation share<16>Basis for participation<17>1 Does not have 14 _The full or abbreviated official name of the organization and its organizational and legal form (joint stock company, limited liability company, partnership, production cooperative, fund, and others) are indicated. 15 _The authorized capital is indicated in accordance with the constituent documents of the organization as of the reporting date. For authorized capital denominated in foreign currency, the authorized capital is indicated in rubles at the rate of the Bank of Russia as of the reporting date. 16 _The share of participation is expressed as a percentage of the authorized capital. For joint-stock companies, the nominal value and number of shares are also indicated. 17 _The basis for the acquisition of a participation interest (memorandum of association, privatization, purchase, exchange, donation, inheritance, and others), as well as the details (date, number) of the relevant agreement or act, are indicated.

8 5.2. Other securities Type of security<18>Issuer of the security Nominal value of the liability Total number Total value<19>1 None Total for section 5 "Information on securities" total declared value of securities, including participation interests in commercial organizations. 18 _ All securities are indicated by type (bonds, bills of exchange and others), with the exception of shares specified in subsection 5.1 "Shares and other participation in commercial organizations and funds". 19 _The total value of securities of this type is indicated based on the cost of their acquisition (if it cannot be determined, based on the market value or nominal value). For liabilities denominated in a foreign currency, the value is indicated in rubles at the exchange rate of the Bank of Russia as of the reporting date.

9 Section 6. Information about obligations of a property nature 6.1. Real estate objects in use<20>Type of property<21>Type and terms of use<22>Reason for use<23>Location (address) Area (sq. m) 1 Apartment Gratuitous use from 2014 to the present actual provision by Ivanov I.I. (husband) Moscow Region, Khimki, Lenina St., 13, kv.30 78.0 2 Apartment moscow, ul.lavochkina, 6, apt. (husband) Spain, Catalonia, Salou, Alley Jaime, I el Conquistodor, 4 50.0 20 _Indicated as of the balance sheet date. 21 _The type of real estate is indicated ( land plot, residential building, cottage and others). 22 _Specify the type of use (lease, free use and others) and terms of use. 23 _The basis for use (agreement, actual provision, etc.) is indicated, as well as the details (date, number) of the relevant agreement or act.

10 6.2. Term liabilities of a financial nature<24>Content of the obligation<25>creditor (debtor)<26>The basis of occurrence<27>Amount of liability/amount of liability as of the reporting date<28>Terms of commitment<29>1 does not have 2 3 I confirm the accuracy and completeness of this information. February 10, 2015 (signature) Ivanov Ivan Ivanovich (signature of the person submitting the information) (Full name and signature of the person who accepted the certificate) rubles, the creditor or debtor of which is the person whose information about the obligations is presented. 25 The essence of the obligation is indicated (loan, credit, etc.). 26 The second party of the obligation is indicated: the creditor or the debtor, his surname, name and patronymic (name legal entity), address. 27 The basis for the occurrence of the obligation, as well as the details (date, number) of the relevant agreement or act are indicated. 28 The amount of the principal liability (excluding the amount of interest) and the amount of the liability as of the reporting date are indicated. For liabilities denominated in a foreign currency, the amount is indicated in rubles at the exchange rate of the Bank of Russia as of the reporting date. 29 The annual interest rate obligations, pledged to secure an obligation; property issued to secure an obligation; guarantees and guarantees.

EXAMPLE OF COMPLETION Fields are not mandatory APPROVED by Decree of the President of the Russian Federation of June 014 N 460 To the Directorate for Personnel Policy (the name of the personnel department is indicated

EXAMPLE OF COMPLETION APPROVED by Decree of the President of the Russian Federation dated June 3, 014 460 (as amended by Decrees of the President of the Russian Federation dated 19.09.017 431, dated 09.10.017 47) To the Asset Protection Department

EXAMPLE OF FILLING * in green information is marked, the indication of which is desirable (recommended) APPROVED by the Decree of the President of the Russian Federation of June 014 460

As part of the declaration campaign The example of filling in was APPROVED by the Decree of the President of the Russian Federation dated June 3, 04 460 (as amended by the Decrees of the President of the Russian Federation dated 09.09.

Approved by Decree of the President of the Russian Federation dated June 23, 2014 460 B (the name of the personnel department of the federal state body, other body or organization is indicated)

APPROVED by Decree of the President of the Russian Federation dated 06.04 460 B (the name of the personnel department of the federal state body of another body or organization is indicated)

CERTIFICATE on income, expenses, property and liabilities of a property nature Approved by Decree of the President of the Russian Federation dated June 23, 2014 460 B

APPROVED by Decree of the President of the Russian Federation dated 06.04 460 B (the name of the personnel department of the federal state body, other body or organization is indicated)

APPROVED by Decree of the President of the Russian Federation of June 04 460 To the Department of Personnel and Civil Service Arbitration Court Republic of Khakassia (the name of the personnel department of the federal

Certificate of income, expenses, property and liabilities of a property nature APPROVED by Decree of the President of the Russian Federation dated June 3, 04 460 B (the name of the personnel department is indicated

B APPROVED by Decree of the President of the Russian Federation of.06.04 460 Department of Personnel and Public Service of the Arbitration Court of the Ural District (the name of the personnel division of the federal

Approved by Decree of the President of the Russian Federation of June 23, 2014 N 460 B (the name of the personnel department of the federal state body, other body or organization is indicated)

To the Human Resources and Civil Service Department of the Intellectual Property Rights Court CERTIFICATE * (on income, expenses, property and property obligations * (I, (last name, first name, patronymic, date of birth,

APPROVED by the Decree of the Governor of the Moscow Region dated December 04 6-PG FORM B (the name of the personnel unit of the public authority of the Moscow Region, the state

APPROVED by the Decree of the Governor of the Kirov region dated 7..04 5 CERTIFICATE on income, expenses, property and obligations of a property nature

EXAMPLE OF COMPLETION * green color indicates information, the indication of which is desirable (recommended) APPROVED by the Decree of the President of the Russian Federation dated June 3, 014 460 To the Asset Protection Department of the State Corporation

To the Human Resources and Municipal Service Department of the Administration of the Yuzhnouralsk Urban District CERTIFICATE on income, expenses, property and obligations of a property nature I, (last name, first name, patronymic,

B (the name of the personnel unit of the local self-government body or its sectoral body that performs the functions and powers of the founder of the municipal institution is indicated) INCOME CERTIFICATE,

FORM OF THE CERTIFICATE on income, expenses, property and liabilities of a property nature (the name of the personnel service of the local self-government body of the Stavropol municipality is indicated

APPROVED by Decree of the President of the Russian Federation dated 06/23/2014 460 To the administration of the Alexandrovsky Village Council of the Aleksandrovsky District Orenburg region(indicate the name of the personnel department

APPROVED by the Decree of the President of the Russian Federation of.06.0 60 To the department of personnel and legal work of the Department of Culture and Tourism of the Smolensk region (the name of the personnel division of the federal

Appendix 2 to the order of the administration of the municipality "Kotlas" dated January 26, 2015 24-r B (the name of the personnel body of local self-government is indicated) CERTIFICATE on income, expenses, property and obligations

To the Council of MR "Chernyshevsky District" APPROVED by Decree of the President of the Russian Federation dated 06.014 460

DECISION of the Administration of the Municipal Formation "Makarov City District" of the Sakhalin Region dated January 22, 2015, 29 Makarov On Amendments to the Resolution of the Administration of the Municipal Formation

Approved by Decree of the President of the Russian Federation dated June 23, 2014 460 To the Administration of the Istra City District (the name of the personnel department of the federal state body, other

June 23, 2014 N 460 DECREE OF THE PRESIDENT OF THE RUSSIAN FEDERATION ON APPROVAL OF THE FORM OF INCOME, EXPENSES, PROPERTY AND PROPERTY LIABILITIES AND AMENDMENTS TO SOME 1

Official APPROVED by Decree of the President of the Russian Federation dated June 23, 2014 460 To the Department of Public Service, Personnel and Administration of the Ministry (the name of the personnel

June 23, 2014 460 DECREE OF THE PRESIDENT OF THE RUSSIAN FEDERATION ON APPROVAL OF THE FORM OF INCOME, EXPENSES, PROPERTY AND PROPERTY LIABILITIES AND AMENDMENTS TO SOME ACTS

APPROVED by Decree of the President of the Russian Federation dated 06/23/2014 460 To the Department of Administration of the Ministry of Labor and social protection Russian Federation (indicate the name of the personnel department

"On Approving the Form of a Certificate of Income, Expenses, Property and Liabilities of a Property Nature and Amending Some Acts of the President of the Russian Federation" www.consultant.ru June 23

June 23, 2014 N 460 DECREE OF THE PRESIDENT OF THE RUSSIAN FEDERATION ON APPROVAL OF THE FORM OF INCOME, EXPENSES, PROPERTY AND PROPERTY LIABILITIES AND AMENDMENTS TO SOME ACTS

Certificate of income, expenses, property and liabilities of a property nature (sample filling) APPROVED by Decree of the President of the Russian Federation of June 23, 2014 N 460 Security Department

APPROVED by Decree of the President of the Russian Federation dated May 8, 009 558 B (the name of the personnel department of the federal state body is indicated) CERTIFICATE on income on property and liabilities

APPROVED by Decree of the President of the Russian Federation dated 06.04 460 B Office of the Commissioner for the Protection of the Rights of Entrepreneurs in Kaliningrad region(the name of the personnel department of the federal

APPROVED by Decree of the President of the Russian Federation dated 06/23/2014 460 B of the Department of Personnel and Civil Service of the Russian Federation (the name of the personnel unit of the federal state

APPROVED by Decree of the President of the Russian Federation dated June 23, 2014 460 To the Department of Control and Personnel of the Ministry of Culture of the Russian Federation

Official APPROVED by Decree of the President of the Russian Federation dated June 23, 2014 460 To the Department of Public Service, Personnel and Administration of the Ministry (the name of the personnel

APPROVED by Decree of the President of the Russian Federation of June 23, 2014 460 (form) To the Department of Public Service and Personnel of the Government of the Russian Federation (the name of the personnel unit is indicated

APPROVED by Decree of the President of the Russian Federation of June 04 460 The name of the personnel unit of the federal state body, other body or organization is entered) CERTIFICATE on income,

Approved Decree of the President of the Russian Federation of June 23, 2014 460 To the Administration of the Ust-Gryaznukhinsky rural settlement (the name of the personnel unit of the federal state body, other body

Approved by Decree of the President of the Russian Federation dated June 23, 2014 460 In _ the administration of the municipality Zarinsky village council (the name of the personnel division of the federal

sample to department government controlled Administration of the Governor of the Perm Territory (the name of the personnel department of the federal state body, other body or organization is indicated)

Official APPROVED by Decree of the President of the Russian Federation dated June 23, 2014 460 To the Department of Public Service, Personnel and Administration of the Ministry (the name of the personnel

APPROVED by Decree of the President of the Russian Federation dated May 18, 2009 559 To the Department of Administration of the Ministry of Labor of Russia (the name of the personnel division of the federal state body is indicated)

To the commission for monitoring the reliability of information on income, property and property obligations of a deputy of the Legislative Assembly, his wife (wife) and minor children

As part of the declaration campaign APPROVED by the Decree of the President of the Russian Federation dated June 04 460 To the Office of the President of the Russian Federation for Combating Corruption I, born 06.970,

Approved by Decree of the President of the Russian Federation dated 06.014 460 B Department of Education of the Administration of the Istra Municipal District (the name of the personnel division of the federal

DECREE OF THE PRESIDENT OF THE RUSSIAN FEDERATION On approval of the form of a certificate of income, expenses, property and property obligations and amendments to some acts of the President of the Russian Federation

APPROVED by Decree of the President of the Russian Federation dated 06.04 460 To the Office of the Commissioner for the Protection of the Rights of Entrepreneurs in the Kaliningrad Region

APPROVED by Decree of the President of the Russian Federation of June 014 No. 460

APPROVED by Decree of the President of the Russian Federation of June 23, 2014 No. 460 to the Administration of the Podoleshensky rural settlement (the name of the personnel unit of the federal _state

Approved by Decree of the President of the Russian Federation dated May 18, 2009 559 To the Office of the President of the Russian Federation for Public Service and Personnel (the name of the personnel unit is indicated

APPROVED by Decree of the President of the Russian Federation dated May 8, 009 559 B (the name of the personnel department of the federal state body is indicated) CERTIFICATE on income, property and obligations

Official APPROVED by Decree of the President of the Russian Federation dated June 23, 2014 460 To the Department of Public Service, Personnel and Administration of the Ministry (the name of the personnel

APPROVED by Decree of the President of the Russian Federation of.06.0 60 To the Department of Education of the Anzhero-Sudzhensky urban district (the name of the personnel unit of the federal state

ADMINISTRATION OF THE CITY OF YUZHNO-SAKHALINSK RESOLUTION dated March 1, 2013 N 304 ON APPROVAL OF THE REGULATION ON PROVISION BY A PERSON APPLYING FOR THE POSITION OF THE HEAD OF A MUNICIPAL INSTITUTION, A

B APPROVED by the Decree of the President of the Russian Federation dated 08.0.009 9 (the name of the personnel department of the federal state body is indicated) CERTIFICATE on income on property and liabilities

Approved by Decree of the President of the Russian Federation dated June 23, 2014 460 To the Ministry of Health of the Republic of Bashkortostan (the name of the personnel department of the federal state

CHAMBER OF CONTROL AND ACCOUNTS OF THE NARO-FOMINSK MUNICIPAL DISTRICT OF THE MOSCOW REGION ORDER dated March 12, 2015 9 Naro-Fominsk On approval of the form of a certificate of income, expenses, property and liabilities

Approved by Decree of the President of the Republic of Buryatia dated September 24, 2009 318 B (the name of the personnel unit of the state body of the Republic of Buryatia is indicated) Form CERTIFICATE on income, property and

Official APPROVED by Decree of the President of the Russian Federation dated June 23, 2014 460 To the Department of Public Service, Personnel and Administration of the Ministry (the name of the personnel

APPROVED by Decree of the President of the Russian Federation dated June 23, 2014 460 To the Department of Personnel Support and State Civil Service of the Ministry of Health of the Republic of Bashkortostan