What does it look like where there is a profit. Turnover balance sheet: its significance in accounting

Account 90 "Sales" is intended to reflect transactions related to the sale finished products, goods, services. 90 count accounting complex, has a number of sub-accounts. How are sales transactions recorded on account 90? How does account 90 close at the end of the year? We will conduct a detailed analysis of account 90, analyze the implementation process using the example of the sale of finished products and goods, as well as accounting entries on account 90. As mentioned above, account 90 in accounting has several sub-accounts, below are the main sub-accounts used to reflect the implementation.

Debit 99

Posting account 90 in this case generates the following:

- Dt 90/2, Kt 43, 40, 41 “Goods (finished products) written off at the discount price.”

- Dt 90/2, Kt 42 "The trade margin has been carried out."

- Dt 90/2, Kt 44 "the amount of commercial (sales) expenses has been accrued."

Trading enterprises do not form the cost of production, assets purchased for sale are reflected in account 45.

When selling, all additional (commercial) expenses are posted to CT 44 "Distribution costs".

Taxes If an enterprise, in accordance with the procedure established by law, is a payer of excise duty, VAT, then the sale of works, products, services is carried out with the inclusion of these types of tax in the total cost.

90/3, 90/4 taxes billed to buyers are taken into account.

Attention

In the case of conducting international trade by the enterprise, the export duty is taken into account on account 90/5.

How to understand the balance sheet

Costs The production (full) cost of manufactured products is formed on calculation accounts and debited to account 41, 43, 45, 40.

At this price, it is taken into account in the warehouse of finished products, where it is stored until the moment of sale.

When selling goods, products, providing various services and performing work, any organization incurs additional costs that are not included in the cost of manufactured products.

This type of costs is called commercial costs, which arise as a result of the preparation and sale of products. These include, according to PBU No. 10/99, the costs of advertising, additional packaging, transportation and storage.

How to check profit on the balance sheet

Important

And from what accounts you will collect this, these are the features of your enterprise. You don’t have to rely on 1C for everything. I had an accountant who made a wild profit at a loss-making enterprise simply by closing a month in 1C and handed it over to the tax office! They called their tax office and asked if you made the balance correctly Ksyunya Rad 05/02/2007, 08:25 m,m I am a lawyer and a beginner accountant. Your director asked the question? The answer is interesting to me. I want to learn how to own information.

Suppose the director asks what profit we are asking for, and I give him ... .. Generate a balance sheet and see what you have on accounts 90/9 and 91/9. You don’t have to rely on 1C for everything.

90 account - "sales". sub-accounts 90

In fact, you need to enter the data correctly into the program, and everything will be fine Buh2 11/28/2007, 02:01 Tell me more - I will see the profit from the BU, but I need to look at the tax accounts for the NU? Of course. In fact, everything is simple.

Collect your estimated income, estimated expenses and withdraw financial results. I do this all the time. At the beginning of each month, my director asks me to make such a forecast. Anonymous 28.11.2007, 07:08 The more often I read forums, the more I am amazed at how illiterate accountants work. Auditor Tortilla 28.11.2007, 09:24 Anonymous, firstly, these are far from the most stupid questions, and secondly, have you ever met illiterate auditors? Although sometimes it seems to me that if an insufficiently qualified accountant is still forced to ask for advice on the forum - after all, he has to do his job, but illiterate auditors do not even ask for advice ... it is not known what is worse ...

Account 99 "profit and loss"

An example of closing account 90 Consider a simple example of accounting for sales of products on account 90 during the last three months of the year. October: there were two shipments for 118,000 rubles. and 47200 rubles. The cost of the first batch of products is 80,000 rubles, the second - 30,000 rubles.

Account 90.1 on the loan reflects the sale value of products, 90.2 - cost, 90.3 - VAT payable, 90.9 - financial result.

In October, account 90 will look like this: On sub-account 90.9, the financial result for the month is considered, which is defined as the difference between the debit and credit of the account.

In the figure, the balances at the end of the month for each sub-account are indicated in red.

Articles

The structure of analytical accounting For correct operation, sub-accounts of account 90 are opened for the following positions:

- 90/1 "Trading revenue";

- 90/2 "Production cost of goods";

- 90/3 "VAT";

- 90/4 "Excises";

- 90/5 "Export duties";

- 90/9 Profit and/or loss from sales.

Each sub-account is filled throughout the year with business transactions.

The formed turnover at the end of each period closes at 90/9 and has no intermediate balance.

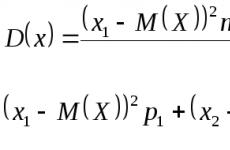

The financial and economic result of the work for the month is calculated as the difference between the debit turnover and the total credit turnover on sub-accounts.

Depending on the sign, the resulting value is posted to subaccount 9, which closes to account 99.

Revenue To reflect the assets recognized under RAS (accounting regulations) 9/99, sub-account 90/1 was created as income from the main type of activity.

Analysis of account 90: sale of finished products, goods

Main sub-accounts to account 90 1 - the loan reflects the proceeds from the sale of goods, products; 2 - the cost of what we sell is entered in the debit; 3 - the debit reflects VAT accrued from the sale; 9 - at the end of the month, the results are summed up on this sub-account: the financial result from sales for the month is considered, profit is recorded on debit, and loss on credit.

We recall that the accounting account is a two-sided table, the left side of which is called debit, and the right side is called credit.

Schematically, score 90 can be depicted as follows: distinctive feature of this account is that it closes completely (to zero) only at the end of the year.

During the calendar year, from month to month, a balance accumulates on each sub-account. At the end of the year, each sub-account is closed, and the total financial result for the year is considered.

If accounting for profit settlements is maintained in accordance with PBU 18/02, then debit account 99 can also correspond, in particular, with account 09 “Deferred tax assets”.

So, accounting entry D99 K09 is made when writing off a deferred tax asset in the event of disposal of the object for which it was accrued.

Closing of account 99 At the end of the year, account 99 is reset to zero with the difference being credited to account 84 “Retained earnings (uncovered loss)”: the so-called “balance sheet reformation” takes place. At the end of the year, posting Debit 99 - Credit 84 means that the revealed total profit according to the results of the year for all types of activities is included in the profits (losses) of previous years.

And the loss according to the results of the year is reflected: Debit 84 - Credit 99.

Reflected the profit at the end of the month from ordinary activities 90, sub-account "Profit / loss from sales" 99 15 000 Thus, account 90 was closed: Account 90 "Sales" Account debit Account credit 18 000 118 000 85 000 15 000 Turnover 118 000 Turnover 118,000 - - If at the end of the month the debit turnover of account 90 turned out to be greater than the credit turnover, then a loss occurs, which is reflected in the reverse entry: Debit 99 - Credit 90.

Similarly, profit and loss are revealed for other types of activities, income and expenses from which are taken into account on account 91: Debit 91 - Credit 99 means that profit was generated for other activities at the end of the month.

Debit 99 - Credit 91 means that there was a loss on other income and expenses for the month.

On which account is the profit in osv displayed at usn

Account 99 – for income tax settlements Account 99 during the year also reflects the amounts of accrued conditional income tax expense and income, permanent tax liabilities and assets, and payments for recalculations of this tax from actual profit, as well as the amounts payable tax sanctions.

So, the accrual of a conditional income tax expense in accordance with PBU 18/02, as well as simply income tax on the basis of a declaration, if accounting for calculations under PBU 18/02 is not kept, will look like this: Debit 99 - Credit 68.

The same entry will reflect the accrual of fines and penalties to the budget for income tax, VAT and other taxes.

Sanctions against extra-budgetary funds (for example, PFR) must be calculated as follows: Debit 99 - Credit 69 “Settlements for social insurance and provision."

This also includes the value of valuables that were received during the liquidation of fixed assets identified during the inventory. Photo: securities Expenses legal entities(corporations) Expenses of organizations that relate to the tax base, in without fail must be supported by documents, be economically justified, refers to the activities of the enterprise, which is aimed at generating income. Failure to meet one of the conditions leads to the fact that the expenses will not be recognized. They are divided into two broad groups:

- expenses that are directly related to the process of production and sale of goods, works, services. Their list is detailed in Art. No. 253 of the Tax Code of the Russian Federation;

- non-operating expenses. Their list is given in Art. No. 265 of the Tax Code of the Russian Federation.

Timely and reliable calculation of income tax is the most important task for enterprises. This is a direct tax.

How to check profit on the balance sheet

As a rule, line 010 is filled in - this is the organization's revenue from the main activity without VAT. In OSV we take the turnover on Credit 90.01, subtract the turnover on debit 90.03 Line 011 is the proceeds from the sale of purchased goods without VAT, here it is necessary to track the amounts that have passed through the posting Dt 62.01 Kt 90.01 (but only if the invoice was the second posting Dt90.02 Kt 41). You can generate an analysis of account 41 and view correspondence from 90.02.

Line 012 is the proceeds from the sale of finished products without VAT, here it is necessary to track the amounts passed through the posting Dt 62.01 Kt 90.01 (but only if the invoice was the second posting Dt90.02 Kt 43). You can generate an analysis of account 43 and view correspondence from 90.02.

How to calculate corporate income tax

When applying the first method, the following intervals are considered to be reporting periods:

- 3 first months from 01.01 to 31.03;

- 6 months from 01.01 to 30.06;

- 9 first months from 01.01 to 30.09.

If the company is given the right to use the second method, then the periods are calculated by months. How the tax rate is distributed With the established tax rate of 20%, according to the legislation of the Tax Code of the Russian Federation, 2% goes to replenish the federal budget of the country, and the regional budget becomes richer by 18%. In full, it goes to the federal treasury from enterprises extracting hydrocarbon raw materials from the sea.

How to calculate income tax? The formula is as follows: NP \u003d (OD - OR) * SNP / 100 Here: NP - income tax; OD - total income; OR - total expenses; SNP - interest rate this tax.

How to calculate corporate income tax in 2014

For the final cleaning of non-operating income from VAT, subtract Dt.ob.91.2 from the total amount of Kt.ob.91.2 (subconto - VAT). We write down the resulting number. 3. We prepare non-operating expenses that are taken into account for taxation, i.e. we clear Dt.ob.91.2 from expenses that are not taken into account for taxation (VAT - see above, fines, penalties). A complete list of expenses can be found in Art. 251 Chapter 21 of the Tax Code of the Russian Federation.

For the final cleaning of non-operating expenses from expenses not taken into account for taxation, we subtract the corresponding subconto (VAT, fine, penalty, etc.) from Dt.ob.91.2. We write down the resulting figure. 4. We prepare the cost of sales (if not only purchased goods were sold, but also goods produced independently) Dt.ob.90.2.1.

Articles

Attention

It is levied on legal entities of any category. It is worth considering that the profit that is calculated by the accounting department and the profit that goes for taxation sometimes do not coincide. Because of this feature, most organizations successfully interact with tax, management and accounting. Methods of calculation Many organizations are under the general taxation regime.

Therefore, the question of how to calculate income tax under OSNO arises quite often. Such a calculation must be carried out very carefully. It is important to remember that the calculation of this payment is regulated by Ch. No. 25 of the Tax Code of the Russian Federation. Indicators of income and expenses must be considered as a cumulative total, and only those that are taxable should be taken into account.

Each organization under the general taxation regime chooses an accounting method.

How to understand the balance sheet

Important

At the same time, we once again check VAT on sales (if the entire sale is subject to 18% VAT, then Kr.rev. 90.1.1 / 118 * 18 = Dt.rev. for each VAT rate For the final clearance of sales from VAT, subtract Dt.ob.90.3 from Kr.ob.90.1.1.

We write down the resulting number. 2. Clear non-operating income (account 91.1) from VAT. This must be done if you have non-operating income subject to VAT (most often this is the rental of property). VAT on non-operating income can be seen in the balance sheet of account 91.2 (VAT subconto).

If you do not have such a subaccount, then take it, then subconto, where you accumulate all VAT on non-operating income. We check the correctness of the calculation of VAT - Kr.ob.91.1 (income subject to VAT) / 118 * 18 = Dt.ob.91.2 (subconto-VAT).

The result must be multiplied by the payment rate and divided by 100. The final amount of tax will be obtained, 18% of which will be transferred to the local budget, and 2% will go to the federal one. Below is the calculation algorithm. Example 1 Plus Limited Liability Company develops and manufactures computer desks.

The initial data for calculating income tax are as follows:

- in the current reporting period, the company issued a bank loan in the amount of 1,000,000 rubles for business development. The prepayment amounted to 400,000 rubles. It should be noted that the loan amounts are not subject to income tax;

- after the first quarter, the proceeds from the sale of tables amounted to 1,770,000 rubles, including VAT 270,000 rubles;

- the amount spent on materials and raw materials amounted to 500,000 rubles;

- The company made a loss last year.

Calculation of profit according to the balance sheet example

Let us note what income tax postings the accounting department performs: that advance payments due during the reporting period must be transferred no later than the 28th day of each month given period. The procedure for calculating income tax for 9 months Taxpayers accrue advance payments based on the results of the first quarter, six months, nine months. The amount of payment for nine months is equal to the income tax for this period minus payments for the first quarter and half a year. Do not forget that during each reporting period, monthly advance payments are also made. How to carry out the calculation was indicated above.

Income of an organization (LLC) In accordance with the current legislation, all the following income of a limited liability company is subject to income tax:

- the amounts received by the organization through the sale of goods, performance of work, provision of services. In this case, it does not matter whether these goods were purchased on the side or produced in-house;

- non-operating income. This is an extensive group, which includes the profit of previous reporting periods, which was revealed in the current year; property received free of charge; interest on loans, commercial loans, securities; dividends.

Sheet 02 Calculation of corporate income tax Line code 010 Sales income Line code 010 must equal Kr.ob.90.1.1 without VAT with VAT) Line code 030 Expenses that reduce the amount of income from sales Line code 030 must equal Dt.ob.90.2.1 + Dt.ob.sch.90.7.1 + Dt.Ob.ac. Line code 040 should equal Dt.ob.91.2 cleared of expenses that are not subject to taxation (VAT, fines, penalties, etc.). Line code 060 Total profit (loss) Line code 060 must be equal to the difference between the sum of all income and all expenses The tax base).

As a reminder, before April 29, 2014, inclusive, taxpayers must submit a tax return for income tax. Corporate income tax return. Turnover balance sheet for account 90.01 for the 1st quarter of 2014 Account analysis

The 1st quarter of 2014 is over, reporting has been submitted to the FSS, and it is time to think about other taxes.

Income tax return for the 1st quarter of 2014

The 1st quarter of 2014 is over, and it's time to think about other taxes.

One of them, which rightfully occupies a leading position in terms of the complexity of determining the tax base and tax accounting, will be discussed in this article - it will be devoted to the quarterly declaration on corporate income tax.

As a reminder, before April 29, 2013 inclusive, it is necessary to submit a tax return on income tax.

In accordance with the provisions of Article 285 of the Tax Code of the Russian Federation, tax period tax is recognized as a calendar year.

The reporting periods for tax are:

The reporting periods for tax are:

- first quarter,

- semester,

- nine months of the calendar year.

The reporting periods that calculate monthly advance payments based on the actual profit received are:

- month,

- two months,

- three months,

- and so on until the end of the calendar year.

The declaration form and the procedure for filling it out were approved by Order dated 22.03.2012. No. ММВ-7-3/ [email protected] "On approval of the form and format for submitting a tax return for corporate income tax, the procedure for filling it out".

Recall that in accordance with the explanations of the Federal Tax Service, given in their Letter dated 15.06.2012. №ED-4-3/ [email protected] "About the tax declaration on corporate income tax", in agreement with the Ministry of Finance, new form tax return is applied starting from the submission of the corporate income tax return for the nine months of 2012.

Taxpayers who calculate monthly advance payments on the basis of actual income received use this declaration form from the submission of the tax return for the seven months of 2012.

Also, before April 29, inclusive, it is necessary to report. They provide the Tax Service on the amounts of income paid to organizations and taxes withheld.

This Calculation was approved by the Order of the Ministry of Taxation of the Russian Federation dated April 14, 2004 No. №SAE-3-23/ [email protected]

"On Approval of the Tax Calculation Form (Information) on the Amounts of Income Paid to Foreign Organizations and Taxes withheld".

Instructions for filling out the above Calculation were approved by the Order of the Ministry of Taxes of the Russian Federation dated 03.06.2002 No. №BG-3-23/275 “On Approval of Instructions for Completing the Tax Calculation Form (Information) on the Amounts of Income Paid to Foreign Organizations and Taxes withheld”.

Corporate income tax return.

To get a general idea of how the income tax return is filled out, you can read the article "Filling out the income tax return for 2011."

Although the above article was written to the declaration form approved by the Order of the Federal Tax Service of Russia dated 12/15/2010 No. No. ММВ-7-3/ [email protected](the previous form of the Declaration), after reading it, a novice specialist will be able to get an idea of the procedure for filling out the current Declaration form, since the principles for filling it out remain the same.

You can download the form of the current form of the Income Tax Declaration in Excel format and the Instructions for filling it out in the "Forms" section in the "Tax reporting" category, heading "Income Tax" on Clerk.Ru.

In the article "Income Tax Registers: Do It Yourself!" You can familiarize yourself with the principles of organizing tax accounting based on company accounting registers.

Calculation (information) about the amounts of income paid to foreign organizations and taxes withheld.

In accordance with paragraph 4 of article 289 of the Tax Code of the Russian Federation, tax agents for income tax, as well as taxpayers, submit income tax returns to the IFTS at their location no later than 28 calendar days from the end of the corresponding quarter.

Information on the requirements of the current legislation regarding income subject to taxation at the source of payment, as well as on the features and income received by a foreign organization from sources in the Russian Federation, can be found in the article “Income tax. Tax agents».

You can download the Calculation form in Excel format and the Instructions for filling out the Calculation in the "Forms" section in the "Tax reporting" category, heading "Income Tax" on Clerk.Ru.

Let's fill in the income tax return for the 1st quarter of 2013 using the example of the accounting and tax accounting data of the Romashka LLC trading company.

To calculate income tax, we will use the analysis data of the following accounting accounts (including, in the context of sub-accounts):

- 41 "Goods" in correspondence with account 90.02 "Cost of sales".

In accordance with the accounting company, for accounting purposes, on account 41, the amounts of duties and are taken into account separately (subaccount 41.02 "Customs duties and fees").

For accounting purposes, these costs are treated as direct.

For purposes tax accounting, according to accounting policy companies, these costs

- 44 “Sales expenses” in correspondence with account 90.07 “Sales expenses”.

In accordance with accounting policy companies for the purposes accounting on account 44 are taken into account in the context of analytics the amount of transportation costs ( direct costs for accounting purposes) and the amount of expenses for brokerage services (also include to direct costs for BU purposes).

For purposes tax accounting, according to the accounting policy of the company, fare are included in direct costs., and the amount of expenses for brokerage services are classified as indirect costs.(i.e. written off in the amount in which they were incurred in the reporting period).

As a result of a different approach to accounting for brokerage services for tax and accounting purposes, temporary differences are formed in accordance with PBU 18/02.

In addition, in accounting, the company creates a reserve for the payment of upcoming vacations.

In tax accounting, such a reserve is not created by the company.

Also, temporary differences in accordance with PBU 18/02 arise for the company in connection with the difference between the amounts of depreciation of fixed assets accrued in tax and accounting records.

- 90 "Revenue".

The company sells products as Russian market and for export. Accordingly, some goods are sold with a zero VAT rate, and some with a VAT rate of 18%.

- 91 "Other income and expenses".

Among other income and expenses of the company, positive and negative sum and exchange rate differences are taken into account.

At the same time, in terms of amount differences, the companies experience temporary differences in accordance with the provisions of PBU 18/02.

LLC "Romashka"

Turnover balance sheet on account 90.01 for the 1st quarter of 2013

- Balance at the beginning of the period

- Turnover for the period

- balance at the end of period

| Check | REVENUE EXCLUDING VAT | VAT | ||||||

| VAT rates | Debit | Credit | Debit | Credit | Debit | Credit | ||

| 90.01.1 | 346 275 490 | 346 275 490 | ||||||

| 18% | 344 990 868 | 0 | 292 365 143 | 52 625 726 | ||||

| 0% | 1 284 621 | 0 | 1 284 621 | 0 | ||||

| Total | 346 275 490 | 346 275 490 | 293 649 764 | 52 625 726 |

We remind you that when calculating the amount of revenue taken into account for tax purposes, the amount of VAT not taken into account.

According to the above data, income from trading operations, net of VAT for income tax purposes, amounted to:

- RUB 293,649,764

LLC "Romashka"

Turnover balance sheet on account 91.01 for the 1st quarter of 2013

| Check | Balance at the beginning of the period | Turnover for the period | FOR NU | |||||

| Other income and expenses | Debit | Credit | Debit | Credit | Prin | NOT PRIN | comments | VAT amounts |

| 91.01 | 39 983 413 | |||||||

| Income - Exchange differences | 355 344 | 355 344 | 0 | |||||

| Income - income from claims made to the carrier | 47 433 | 40 216 | 0 | VAT 7,217 (accounted for on account 91.02) | 7 217 | |||

| Rental income | 5 329 630 | 4 516 636 | 0 | VAT 812 994 (accounted for on account 91.02) | 812 994 | |||

| VAT not accepted for NU purposes | 33 | 0 | 33 | the previously written off VAT on expenses not accepted was restored. at NU | ||||

| Deviations of the rate of sale (purchase) of foreign currency from the official rate | 418 836 | 418 836 | 0 | |||||

| Foreign exchange gain - Unrealized - Loans | 22 742 636 | 22 742 636 | 0 | |||||

| Foreign exchange gain - Unrealized - Other debt | 48 | 48 | 0 | |||||

| Positive difference - revaluation of other accounts payable in c.u. | 1 960 | 0 | 1 960 | revaluation at the end of the month | ||||

| 7 915 627 | 7 915 627 | 0 | ||||||

| Foreign exchange gain - Unrealized Trade Payables in c.u. | 38 747 | 38 747 | 0 | |||||

| Positive foreign exchange difference - Revaluation in currency | 1 332 567 | 1 332 567 | 0 | |||||

| Foreign exchange gain - Repayment of loans | 2 639 | 2 639 | 0 | |||||

| Foreign exchange gain - Other accounts payable in c.u. | 8 753 | 8 753 | 0 | |||||

| Foreign exchange gain - Trade payables | 1 261 354 | 1 261 354 | 0 | |||||

| Claim to the carrier | 50 668 | 42 939 | 0 | VAT 7,729 (accounted for on account 91.02) | 7 729 | |||

| Interest receivable - other | 409 218 | 409 218 | 0 | |||||

| Others. Income from gratuitously received property. | 25 903 | 25 052 | 851 | not accepted for NU, because no doc-in | ||||

| Others. Income of past years | 142 | 142 | 0 | |||||

| Other - correction of errors of previous years identified in the reporting year | 1 313 | 1 313 | 0 | |||||

| Other - writing off Dt and Kt of expired debt | 40 561 | 40 561 | 0 | |||||

| Total | 39 983 413 | 39 152 629 | 2 844 | 827 940 | ||||

According to the above data, other income, net of VAT for income tax purposes, accounted for in non-operating amounts amounted to:

- RUB 39,152,629 Including income from gratuitously received property - RUB 25,052

The amount of income not accepted for income tax purposes was:

- 2 844 rub.

LLC "Romashka"

Analysis of account 90.02 for the 1st quarter of 2013

| Cor. Check | Debit | FOR NU | |

| opening balance | Prin. as part of direct | NOT PRIN | |

| 41 | 186 116 740 | ||

| 41.01 Goods in warehouses | 122 216 265 | 122 216 265 | |

| 41.02 Customs duties and fees | 8 969 919 | 0 | 8 969 919 |

| 41.04 Purchased articles | 54 051 102 | 54 051 102 | |

| 41.07 Goods in warehouses at a rate of 0% (export) | 879 454 | 879 454 | |

| turnover | 186 116 740 | 177 146 821 | |

| ending balance | 186 116 740 | ||

According to the data above, the amount of direct expenses related to goods sold for income tax purposes was:

- 177 146 821 rub.

Expenses for customs duties and fees, taken into account for income tax purposes as part of indirect costs amounted to:

- RUB 10,262,742

LLC "Romashka"

Analysis of account 90.07 for the 1st quarter of 2013

| Cor. Check | Debit | FOR NU | ||

| opening balance | in BU | Prin (indirect costs) | NOT PRIN | |

| 44 | ||||

| 44 "Depreciation" | 5 511 315 | 5 485 409 | 25 905 | |

| 44 Brokerage services | 2 002 660 | 1 975 914 | 26 746 | |

| 44 "Salary" | 7 016 444 | 6 932 668 | 83 776 | |

| 44 "Payments for negative impact on the environment in excess of the norm will not be accepted for NU" | 4 387 | 0 | 4 387 | |

| 44 "I will not accept hospitality expenses at NU" | 102 998 | 0 | 102 998 | |

| 44 "Insurance premiums with FOT" | 1 094 074 | 1 041 816 | 52 257 | reserve amount (+used-accrued) |

| 44 "Acceptable entertainment expenses" | 181 551 | 181 551 | 0 | |

| 44 "Rent" | 7 342 699 | 7 342 699 | 0 | |

| 44 "Outsourcing" | 10 927 244 | 10 927 244 | 0 | |

| 44 "Consulting services" | 855 225 | 855 225 | 0 | |

| 44 "Equipment repair" | 242 623 | 242 623 | ||

| 44 "redecoration of the office" | 75 348 | 75 348 | ||

| 44 "Business trips" | 63 818 | 63 818 | ||

| 44 "Inventory and household supplies" | 106 831 | 106 831 | ||

| 44 "Stationery and other materials" | 2 834 006 | 2 834 006 | ||

| 44 "DMS" | 148 744 | 148 744 | ||

| 44 "Warehouse cleaning" | 101 483 | 101 483 | ||

| 44 "Legal services" | 126 949 | 126 949 | ||

| 44 "Forwarding services" | 15 669 076 | 15 669 076 | ||

| 44 "Other business expenses" | 845 771 | 845 771 | 0 | |

| 44 "Property tax" | 1 351 697 | 1 351 697 | 0 | |

| 44 "Payments for negative environmental impact" | 3 763 | 3 763 | 0 | |

| 44 "Transport tax" | 35 | 35 | 0 | |

| TOTAL | 56 608 740 | 56 312 671 | 296 069 | |

According to the data above, business expenses deductible for income tax purposes as part of indirect expenses were:

RUB 56,312,671 Including: depreciation expenses - 5,485,409 rubles, expenses in the form of taxes and fees - 1,355,495 rubles.

Transportation costs taken into account for tax accounting purposes as part of direct expenses were:

RUB 5,446,026

LLC "Romashka"

Turnover balance sheet on account 91.02 for the 1st quarter of 2013

| Check | Turnover for the period | FOR NU | ||||

| Other income and expenses | Debit | Out of real prin. | NOT PRIN | Indirect taxes) | Losses of previous years | |

| 91.02 | 54 271 228 | |||||

| Exchange differences | 362 751 | 362 751 | 0 | |||

| State Duties | 5 845 | 0 | 0 | 5 845 | ||

| State fees for issuing a work permit for foreigners. citizen | 3 636 | 0 | 0 | 3 636 | ||

| State fees for registration of a lease agreement | 55 | 0 | 0 | 55 | ||

| Non-operating income (VAT) | 7 217 | 0 | 7 217 | 0 | ||

| Rental income from property (including VAT on income) | 5 470 678 | 4 657 683 | 812 994 | |||

| Translation Commission | 150 748 | 150 748 | 0 | |||

| Land and water tax | 83 709 | 0 | 0 | 83 709 | ||

| VAT charged on claims | 7 729 | 0 | 7 729 | |||

| VAT charged on free transfer TMC | 829 | 0 | 829 | |||

| VAT not accepted for NU | 410 248 | 0 | 410 248 | |||

| Deviations of the rate of sale (purchase) of foreign currency from the official rate | 647 529 | 647 529 | 0 | |||

| Foreign Exchange Negative - Unrealized - Loans | 24 758 139 | 24 758 139 | 0 | |||

| Foreign exchange loss - Unrealized - Other accounts payable | 24 | 24 | 0 | |||

| Negative foreign exchange difference - Unrealized - Other accounts payable in c.u. | 1 100 | 0 | 1 100 | |||

| Foreign exchange loss - Unrealized - Trade payables | 8 992 080 | 8 992 080 | 0 | |||

| Negative foreign exchange difference - Revaluation Money in currency | 659 091 | 659 091 | 0 | |||

| Negative foreign exchange difference - Repayment of loans | 789 523 | 789 523 | 0 | |||

| Negative foreign exchange difference - Other accounts payable in c.u. | 2 712 | 2 982 | -270 | |||

| Negative exchange rate difference - Other | 1 | 1 | 0 | |||

| Negative foreign exchange - Trade payables | 1 052 656 | 1 052 656 | 0 | |||

| Foreign exchange gain - Unrealized - Trade payables | 0 | 0 | 0 | |||

| Interest payable - loans and borrowings | 1 727 273 | 1 727 273 | 0 | |||

| Other banking services | 339 | 339 | 0 | |||

| Other income/expenses Correction of errors of previous years identified in the reporting year | 3 886 | 0 | 0 | |||

| Other VAT expenses (not applicable for NU) | 8 641 385 | 0 | 8 641 385 | |||

| Other expenses General expenses of the past period (not applicable for NU) | 6 923 | 0 | 6 923 | |||

| Other expenses General Losses of previous years | 483 810 | 0 | 0 | 487 696 | ||

| Other rental expenses (VAT) | 1 335 | 1 335 | 0 | |||

| Ticket refund fees | 571 | 571 | 0 | |||

| Total | 54 271 821 | 43 802 726 | 9 888 154 | 93 245 | 487 696 | |

According to the data above, other expenses deductible for income tax purposes as part of non-operating expenses were:

RUB 43,802,726 Including expenses on interest from borrowed funds - 1,727,273 rubles.

Amounts of losses of previous years equal to to non-operating expenses were:

RUB 487,696

The amount of taxes and fees taken into account for the purposes of NU as part of indirect expenses amounted to:

RUB 93,245

Based on the above calculations, tax registers were formed for the income tax of Romashka LLC for the 1st quarter of 2013:

Tax register for income accounting for NU purposes

For the 1st quarter of 2013

| Income | In the declaration | |||

| account number | sum | Type of income | sheet number | line number |

| 90.01 account | 293 649 764 | from the purchase of goods | appendix 1 to sheet No. 2 | 012 |

| 91.01 account | other assets | appendix 1 to sheet No. 2 | 014 | |

| 293 649 764 | appendix 1 to sheet No. 2 | 010 | ||

| 293 649 764 | TOTAL REVENUE | appendix 1 to sheet No. 2 | 040 | |

| 91.01 account | 39 152 629 | non-operating | appendix 1 to sheet No. 2 | 100 |

| 91.01 account | 25 052 | including gratuitous receipts | appendix 1 to sheet No. 2 | 103 |

| 91.01 account | from the sale of OS | appendix 3 to sheet No. 2 | 030 |

| TOTAL INCOME | 332 802 393 |

Tax register for accounting expenses for NU purposes

For the 1st quarter of 2013

| Expenses | In the declaration | |||

| account number | sum | Type of expenses | sheet number | line number |

| 90.02 account | 177 146 821 | direct purchase goods | appendix 2 to sheet No. 2 | 030 |

| 90.07 (from 44 "transport costs") | 5 446 026 | direct shipping costs | appendix 2 to sheet No. 2 | 020 |

| TOTAL direct costs | 182 592 847 | appendix 2 to sheet No. 2 | 020 | |

| 90.02 account | 177 146 821 | including cost of goods | ||

| 90.07 (from 44 accounts minus tr.expenses, taxes and reserves) | 54 957 176 | indirect costs | appendix 2 to sheet No. 2 | 040 |

| 90.02 (from account 41.02) | 10 262 742 | Customs duties and fees | appendix 2 to sheet No. 2 | 040 |

| 91.02 account | 93 245 | including taxes (land + water + state duties) | appendix 2 to sheet No. 2 | 041 |

| 90.07 (from 44 accounts) | 1 355 495 | including taxes (im + NEGATIVE) | appendix 2 to sheet No. 2 | 041 |

| Total taxes | 1 448 740 | appendix 2 to sheet No. 2 | 041 | |

| TOTAL indirect costs | 66 668 658 | appendix 2 to sheet No. 2 | 040 |

| only at NU | 4 083 | according to the calculation of the loss from fixed assets | appendix 2 to sheet No. 2 | 100 |

| 91.02 account | price of other assets | appendix 2 to sheet No. 2 | 060 | |

| Costs from fixed assets and shares | appendix 2 to sheet No. 2 | 080 | ||

| 91.02 account | shares | sheet number 5 | 030 | |

| 249 265 588 | TOTAL expense recognized | 130 | ||

| 5 485 409 | total depreciation for NU | appendix 2 to sheet No. 2 | 131 | |

| depreciation of intangible assets | appendix 2 to sheet No. 2 | 132 | ||

| 91.02 account | 43 802 726 | non-operating | appendix 2 to sheet No. 2 | 200 |

| 91.02 account | 1 727 273 | interest on borrowed funds | appendix 2 to sheet No. 2 | 201 |

| 91.02 account | 487 696 | losses e.g. to non-operating expenses | appendix 2 to sheet No. 2 | 300 |

| 91.02 account | 487 696 | prior cash losses | appendix 2 to sheet No. 2 | 301 |

| TOTAL non-realistic expenses | 44 290 422 | |||

| TOTAL EXPENSES | 293 556 009 | |||

| profit before tax | 39 246 383 |

Note:LLC "Romashka" according to the results of 9 months of 2012. the amount of advance payments for the 4th quarter. 2012 and per 1 sq. 2013 amounted to 0.00 rubles.

Accordingly, for 1 sq. 2013 7,849,277 rubles were calculated for additional payment. And the company reflects the same amount as the amount of the advance payment for 2 square meters. 2013

In this article I will try plain language explain to you how to complete your income tax return. This mini-guide is suitable for completing quarterly, half-yearly, nine-monthly and yearly declarations.

To facilitate the subsequent calculation and for possible analysis, we print out:

reverse balance sheets according to sch. 90.1.1 (revenue),

turnover balance sheets for account. 90.2.1 (cost of sales),

turnover balance sheets for account. 90.3 (VAT),

turnover balance sheets for account. 91.1 (other income - non-operating income),

turnover balance sheets for account. 91.2 (other expenses - non-operating expenses).

To further facilitate the work, all calculations can be recorded under the balance sheet (and during the tax audit there will be no extra questions from the inspectors checking you).

We prepare the "numbers" for the calculation:

1. We clear the sale from VAT. (Kr.ob. 90.1.1-Dt.ob.90.3). At the same time, we once again check VAT on sales (if the entire sale is subject to 18% VAT, then Kr.rev. 90.1.1 / 118 * 18 = Dt.rev. for each VAT rate For the final clearance of sales from VAT, subtract Dt.ob.90.3 from Kr.ob.90.1.

2. Clear non-operating income (account 91.1) from VAT. This must be done if you have non-operating income subject to VAT (most often this is the rental of property). VAT on non-operating income can be seen in the balance sheet of account 91.2 (VAT subconto). If you do not have such a subaccount, then take it, then subconto, where you accumulate all VAT on non-operating income. We check the correctness of the calculation of VAT - Kr.ob.91.1 (income subject to VAT) / 118 * 18 = Dt.ob.91.2 (subconto-VAT). For the final cleaning of non-operating income from VAT, subtract Dt.ob.91.2 from the total amount of Kt.ob.91.2 (subconto - VAT). We write down the resulting number.

3. We prepare non-operating expenses that are taken into account for taxation, i.e. we clear Dt.ob.91.2 from expenses that are not taken into account for taxation (VAT - see above, fines, penalties). A complete list of expenses can be found in Art. 251 Chapter 21 of the Tax Code of the Russian Federation. For the final cleaning of non-operating expenses from expenses not taken into account for taxation, we subtract the corresponding subconto (VAT, fine, penalty, etc.) from Dt.ob.91.2. We write down the resulting figure.

4. We prepare the cost of sales (if not only purchased goods were sold, but also goods produced independently) Dt.ob.90.2.1. From the total amount Dt.ob.90.2.1 we “pull out” the cost of resold goods and the cost of self-produced and sold goods. The resulting numbers are recorded. In total, the recorded figures should give Dt.ob.90.2.1.

We fill tax return on income tax.

Starting with Annexes No. 1 to Sheet 02 Sales income and non-operating income:

Line code 010 Total revenue=Line code 011+Line code 012+Line code 013+Line code 014

Line code 011-014 We look at the prepared “figure” for calculation under number 1 (implementation without VAT - cleared turnover 90.1.1 from VAT) and put down the results in accordance with the indicators of the form.

011 - production, 012 - trade. Line code 010 must be equal to Cr.ob.90.1.1 without VAT.

Line code 100 Non-operating income

We look at the prepared “figure” for calculation under number 2 (non-operating income Kr.ob.91.1, if there were income with VAT, then non-operating income cleared of VAT) and put down the results in accordance with the indicators of the form. If your non-operating income does not fall into Line Codes 101-107, then we put the result without decoding in Line Code 100.

Annexes No. 2 to Sheet 02 Expenses related to production and sale, non-operating expenses and losses:

Line code 010 Direct costs .We look at the prepared figure at number 4 and write down the cost of self-produced and sold goods.

Line code 020 Direct trade costs. We look at the prepared figure at number 4 and write down the cost of resold goods (wholesale, retail).

Line code 010+Line code 020=Dt.ob.90.2.1

Line code 040 Indirect costs - total We write down the amount of Dt.ob.sch.90.7.1 (Sales expenses), and Dt.Ob.sch.90.8.1 (Administrative expenses). If you do not have turnovers on one of the accounts, then write down the turnovers of the account that you have.

Line code 130 Total recognized expenses Line code 010+Line code 020+Line code 040

Line code 131 or 133 depreciation amount for the reporting period Depending on which depreciation method you have chosen, you enter the selected code in Line Code 135 and Cr. sch. 02.1 in line code 131 or 133

Line code 200 Non-operating expenses - total We look at the prepared figure at number 3 and write it down. If your non-operating expenses do not fall into Line Codes 201-206, then we put the result without decryption in Line Code 200.

Sheet 02 Calculation of corporate income tax

Line code 010 Sales income Line code 010 must be equal to Cr.ob.90.1.1 without VAT

Line code 020 Non-operating income Line code 020 should be equal to Kr.ob.91.1 without VAT (if you have non-operating income with VAT)

Line code 030 Expenses that reduce the amount of income from sales Line code 030 should equal

90.2.1 + 90.7.1 + 90.8.1 + 90.8.1

Line code 040 Non-operating expenses Line code 040 should equal Dt.ob.91.2 cleared of expenses that are not subject to taxation (VAT, fines, penalties, etc.).

Line code 060 Total profit (loss) Line code 060 must equal the difference between the sum of all income and all expenses

If you do not have income excluded from the tax base (line codes 070-090), then transfer the result of Line code 060 to Line code 100 (Tax base).

If you did not reduce the profit of the reporting period by losses of previous years (Appendix 4 to Sheet 02), then we duplicate the figure from Line Code 100 to Line Code 120 (Tax base for tax calculation).

Line code 140 Income tax rate The income tax rate for the budgets is 20% (Article 284, Chapter 25 of the Tax Code of the Russian Federation), including FB-2%, the budget of the constituent entities of the Russian Federation-18%.

If an organization applies PBU 18/02, then it is necessary to check the correctness of the calculation of income tax. The amount of the current income tax must correspond to the income tax calculated according to. It is necessary to reconcile the calculated income tax with the balance sheet on account 68.04.1 “Settlements with the budget”.

Step 1. Calculate the conditional income (expense)

Information is filled in on the basis of data on accounting profit (loss) on account 99.01.1 "Profits and losses from activities with the main taxation system". For this account, the final closing data of accounts 90.09 “Profit / loss from sales” and 91.09 “Balance of other income and expenses” are formed.

The calculation is based on the profit or loss resulting from the difference between the credit turnover of account 99.01.1 and its debit turnover:

- January - accounting profit -822 393,51 check (834 144.97 - 11751.46).

- February - accounting profit - 129190 ,21 verification (146,961.71 - 17,771.50).

- March - accounting profit - 139RUB 461.05 verification (157,958.71 - 18,497.66):

Conditional expense (income) results:

Step 2. Compare the calculation of the conditional income (expense) with the SALT

Compare the calculation of conditional income (expense) with OSV on account 99.02.1 “Conditional income tax expense” and 99.02.2 “Conditional income tax:

Step 3: Verify that the total amount of current income tax is calculated correctly

Check the correctness of the calculation of the total amount of current income tax, which consists of the amount:

- Deferred tax assets D 09 K 68.04.2;

- Deferred tax liabilities D 68.04.2 K 77;

- Permanent tax assets D 68.04.2 K 99.02.3;

- Permanent tax liabilities D 99.02.3 K 68.04.2;

- Conditional consumption Dt 99.02.1 Kt 68.04.2;

- Conditional income Dt 68.04.2 Kt 99.02.1.

You can check by comparing the data in the table:

Checking the data from the example:

- Summary data for the 1st quarter:

- PNO = 9,782.98 rubles.

- SHE \u003d 0 rubles.

- Conditional consumption = 218,208.95 rubles.

- Total: 227,991.93 rubles.

- PNA = 0 rub.

- IT \u003d 56,022.64 rubles.

- Conditional income = 0 rub.

- Total: RUB 56,022.64

- Income tax payable: 227,991.93 - 56,022.64 = 171,969.29 rubles.

The total amount of accrued current income tax is 171,969.29 rubles. For this amount, a transaction is made for the accrual of income tax in the context of budgets Dt 68.04.2 Kt 68.04.1.

Step 4. Analysis of the state of tax accounting for income tax in 1C 8.2

Check the data of the SALT, formed on the basis of NU with the report Analysis of the state of tax accounting for income tax:

Rate this article: